Sports Ad Spending in 2026: Where Attention Concentrates, and How Brands Win

Winter Olympics, FIFA World Cup, Super Bowl: 2026 is a mega year for ad spend in sports. Check out the marketer’s playbook for timing, spend shifts, and fan-first creativity that gets shared.

2026 is lining up as a high-demand year for sports advertising, and you can see it in the market before the big events even start. NBCUniversal says it’s **already sold out its Milano Cortina 2026 Winter Olympics**ad inventory one month out, after an “extraordinary” February run-up that also includes Super Bowl LX and NBA All-Star Weekend.

At the same time, sports viewing keeps tilting toward digital-first distribution. Nielsen reported streaming hit 44.8% of total TV viewing in May 2025—beating broadcast + cable combined for the first time. And Nielsen’s latest Gauge reporting shows streaming can push even higher during tentpole moments (December 2025 hit 47.5% of TV viewing, with a single-day record of 54% on Christmas Day).

So the “why 2026?”, the answer is simple: scarce premium inventory + convergent viewing + stacked mega-events = budgets concentrate fast. Let’s get into it.

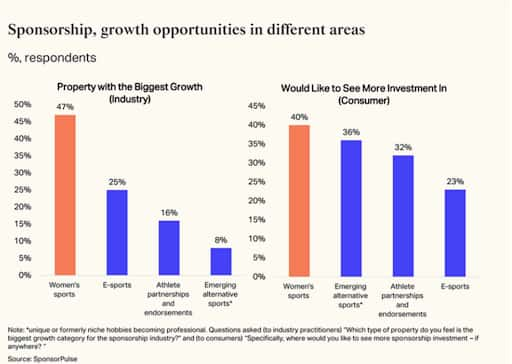

Sports sponsorship is evolving

Not long ago, sports sponsorship followed a predictable formula: buy the rights, secure logo visibility, run a TV spot.

That model is breaking under the weight of how sports now live across platforms.

Major events are no longer single broadcasts. They’re always-on ecosystems — live games, highlights, social clips, creator commentary, athlete channels, memes, reactions, and post-game analysis. The brands winning in 2026 are acting less like sponsors and more like publishers.

Instead of betting everything on one hero moment, they build what could be called “lots of littles”: many small, fast, platform-native activations stitched into one coherent story across the season.

And the talent ecosystem has changed too. WARC notes in their report how athletes are increasingly media channels themselves** **(YouTube, TikTok, podcasts), creating more sponsor-friendly inventory that feels native to fan behavior.

What that means for marketers in 2026:

- Rights aren’t the strategy. Distribution is. Treat sponsorship as a content pipeline with planned cutdowns and platform-native edits.

- Plan for speed. Real-time moments (injuries, upsets, surprise stars) move the needle—if you have pre-approved creative systems ready.

- Make the brand useful to fandom. Access, behind-the-scenes, limited drops, fan tools, live viewing boosts—things that add value to the moment.

What works in sports advertising in 2026: the new baseline

1. Convergent TV, not “TV vs. digital”

Sports is now the cleanest example of convergent viewing: big-screen live moments, followed immediately by highlight culture on social.

Nielsen’s Ad Supported Gauge shows the ad market still lives in ad-supported viewing, and streaming is taking a growing share of that opportunity set.

2. Streaming is not just reach, it’s outcomes

EDO’s 2024–25 NFL outcomes report found:

- Streaming-exclusive NFL games delivered 66% stronger ad effectiveness than the broadcast/cable average.

- NFL ads were also 243% more effective during the Super Bowl versus the TV average.

Translation: the 2026 play isn’t “be everywhere.” It’s in** the premium environments where attention converts**.

3. Creative that behaves like fan content

The best-performing sports work doesn’t feel like a brand interrupting the game—it feels like a fan artifact:

- reveals (kits, lineups, collabs)

- city takeovers

- countdown rituals

- reactions, banter, receipts

- behind-the-scenes “proof” content

This is where you can bridge into Mixed Reality without it feeling bolted on.

Why Mixed Reality ads are peaking

In a year where budgets cluster around mega-events, brands face a predictable problem: inventory gets expensive and crowded. When everyone buys the same moments, the differentiator becomes what people choose to share after the moment.

That’s exactly where Mixed Reality (FOOH-style executions) fits—because it turns a sports moment into a social object: something fans pass along because it feels like it belongs to the event.

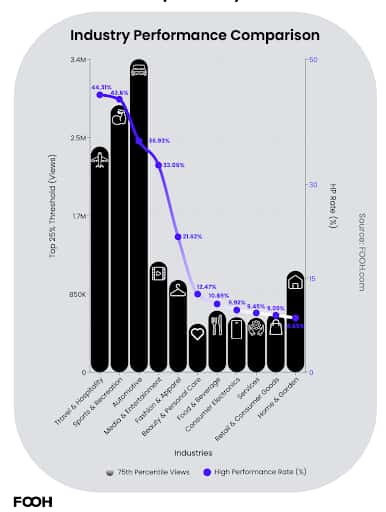

These patterns are reflected in the FOOH Trend Report 2026, which benchmarks mixed-reality campaign performance across thousands of executions and multiple industries.

- Within that dataset, Sports & Recreation consistently emerges as one of the strongest-performing categories. Fan passion creates built-in share mechanics — jersey reveals, stadium takeovers, and city-scale moments naturally travel through feeds once amplified with Mixed Reality.

- Automotive also over-indexes in the benchmarks, albeit for different reasons. It’s a category with high visibility thresholds, but when campaigns achieve cultural relevance at scale, performance accelerates sharply. Large-format moments and location-led reveals reward ambition once they cross the attention bar.

The full breakdown — including category benchmarks, performance tiers, and distribution patterns — is detailed in the FOOH Trend Report 2026, which is available for download HERE.

What Mixed Reality adds in 2026 (specifically)

- Speed + scalability: you can create “event-sized” moments without building them physically, then localize by city/team/player.

- Share mechanics: the format is inherently clip-friendly—designed for short-form distribution.

- Sponsor unlock: it lets sponsors show up bigger than their media weight by making a moment feel culturally “present.”